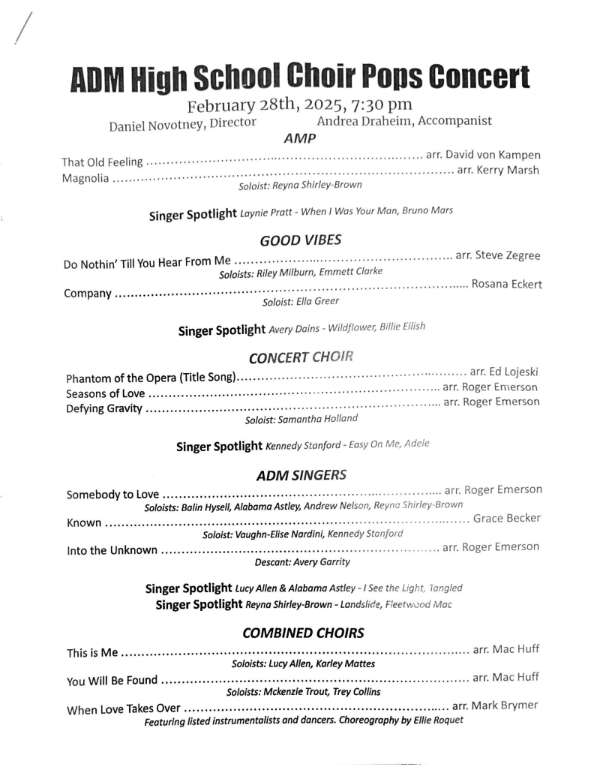

I’m sure most of you have seen the trend of girls on TikTok explaining their spending quirks by using the term “Girl Math.”

An example of Girl Math could be the feeling of something being free just because you bought it with cash, therefore you didn’t see the money leave your account. Or, it could be returning a product, getting store credit, and feeling as if you walked away from the transaction making money, so you immediately go and spend what the store just returned to you. My personal favorite is buying something expensive but breaking it down to decipher the cost per wear/use to argue that it’s a great deal.

What lots of teenage girls astonished with this phenomenon didn’t (or did) know is that this resembles a few actual principles of economics. One of them is called a sunk cost. In easy words, a sunk cost is a cost that cannot be recovered, so it shouldn’t be considered when making decisions. Sunk costs are unavoidable in life so they should not control your expenditures; think of tuition, rent and subscription fees. You can never recover those costs, so according to Girl Math and economics, they essentially “don’t count.” When I think of sunk costs trying to be explained easily, I think of a vending machine. Say you put in $2 to get a Pepsi. After the Pepsi is distributed, you realize you would rather have a Coke. It is irrational to only drink the Pepsi because you already spent money on it due to the fact that you can’t get that money back, so it should not even be thought of when deciding to spend another $2 to buy a Coke. Another example is tuition. Say halfway through college you start deciding that your major is not what you want to do for your life. It is irrational to stay in that major just because you have already paid tuition for half of it. You can’t get it back; it shouldn’t define your choice.

If you’re not justifying purchases by considering something a sunk cost, you might be legitimizing them by falling victim to framing and anchoring. Using Girl Math mentality means that you often separate a discount from the original price. Marketers are well aware of this and use framing to accentuate a discount from the original cost of an item, which anchors us in as consumers. Essentially the money leftover from using the discount is considered “found money” so anything you buy with that is free (according to Girl Math, of course.) The feeling of using found money as if it grows on trees is addicting; it’s rewarding and you don’t even feel like you’re spending anything.

Probably the most known principle in female consumerism is cost per wear. I remember using this as a little girl while shopping with my mom. We would reason with our purchases by dividing the price tag by the number of times we would wear or use an item. Girl Math calls this “investing in yourself.” Essentially, if you buy something expensive and wear it or use it so often that the cost per wear is incredibly low, that item was an investment to yourself. Out of the three principles I have covered so far, I would consider this one to be the least financially detrimental. Expensive things make it hard to swipe your card at the register, but knowing that it is an item that you have wanted and will wear as often as you can is reassuring. Just remember to inspect the quality of your item; walking out of the store after just spending a whole paycheck on an item and it breaks or rips the first time you wear or use it is a feeling I wish on no one.

When all is said and done, Girl Math isn’t the form of “bad math” that it often gets called. As it turns out, the girlies have been financial risk analysts all along.